Break the Panic Cycle: My Real Talk on Staying in Control When Money Gets Tight

Life hits hard sometimes—a sudden job loss, a busted car, or an unexpected bill. I’ve been there, heart racing, staring at a zero bank balance, wondering how to survive the next week. But what kept me from drowning wasn’t luck. It was a plan. Not some flashy investment hack, but solid, grounded strategies built on risk control and clear thinking. Here’s how I learned to stay calm, protect what I had, and make smart moves—even when everything felt like it was falling apart. This isn’t about getting rich quick. It’s about not falling apart when money runs thin. And it starts with understanding that financial stress, while deeply personal, follows predictable patterns—ones we can prepare for, manage, and ultimately overcome.

The Moment Everything Shook: Facing a Real Financial Emergency

It started with a phone call no one wants to get. A week before rent was due, I was told my position was being eliminated—no warning, no severance, just a polite but final goodbye. In that moment, everything shifted. The first reaction wasn’t strategy or planning. It was panic. My mind raced through worst-case scenarios: Could I afford groceries? Would I be able to keep the lights on? What if the car broke down? These weren’t abstract worries—they were immediate, pressing threats. The silence after hanging up felt heavier than any noise. I sat at the kitchen table, staring at bills stacked like a tower ready to collapse. That silence was filled with fear, yes, but also with something else: a strange clarity. I realized that while I couldn’t control the job loss, I could control how I responded. And that distinction—between what happens to us and how we act—became the foundation of my recovery.

Financial emergencies don’t always come with warning labels. They arrive disguised as routine phone calls, medical letters, or surprise repair estimates. What makes them so destabilizing isn’t just the cost, but the emotional toll. The brain, under financial stress, reacts much like it does under physical threat. Cortisol spikes. Rational thinking narrows. Decisions become reactive rather than strategic. This is why so many people, in moments like mine, make choices they later regret—racking up credit card debt, pulling money from retirement accounts, or avoiding the problem altogether. But recognizing this biological response is the first step toward regaining control. When you understand that panic is a natural reaction, not a personal failure, you can begin to treat the situation not as a disaster, but as a challenge to be managed. And like any challenge, it requires a plan, not a reaction.

What changed everything for me was shifting my mindset from survival to strategy. Instead of asking, “How will I survive this?” I began asking, “What can I control right now?” That small shift opened up space for action. I listed every expense, every income source, every possible option—even the uncomfortable ones. I accepted that this was a temporary crisis, not a permanent identity. I reminded myself that financial setbacks do not define a person’s worth or future. This mental reset didn’t erase the stress, but it gave me a tool: perspective. And with perspective came the ability to act with intention, not impulse. The emergency hadn’t changed, but my relationship to it had. That’s when I began to rebuild—not just my finances, but my confidence in handling them.

Why Most People Make It Worse (And How to Avoid It)

When money gets tight, the instinct for many is to do something—anything—to make the pressure go away. But action without strategy often leads to deeper trouble. One of the most common missteps is charging essential expenses to high-interest credit cards, hoping to catch up later. The problem is, later rarely comes with more breathing room. Instead, interest compounds, minimum payments grow, and what started as a short-term fix becomes a long-term burden. Another frequent reaction is freezing—ignoring bills, avoiding bank statements, and hoping the problem will resolve itself. Denial may offer temporary relief, but it only magnifies the crisis when reality finally catches up. These responses, though understandable, stem from emotion, not logic. And in financial emergencies, emotion is rarely the best advisor.

Behavioral finance shows us that people under stress tend to focus on immediate relief rather than long-term consequences. This is known as present bias—the tendency to prioritize short-term comfort over future stability. It’s why someone might take out a payday loan with a 400% annual percentage rate (APR) to cover a $300 car repair. In the moment, it feels like a solution. In reality, it’s a trap. These high-cost, short-term loans often lead to cycles of debt that are hard to escape. Similarly, selling long-term investments at a loss during a market dip—just to cover a sudden expense—locks in losses and undermines future growth. These decisions aren’t made lightly, but they are made under pressure, without the benefit of clear thinking or time to evaluate alternatives.

The difference between those who recover and those who spiral often comes down to one factor: discipline. Financial resilience isn’t about having a large bank account. It’s about having a process. People who manage crises well don’t avoid stress—they manage it. They accept that discomfort is part of the process and resist the urge to eliminate it through risky moves. Instead, they focus on what’s within their control: spending, communication, and prioritization. They reach out to creditors, negotiate payment plans, and adjust their budgets—actions that require courage, not just cash. They understand that preserving long-term stability is more important than achieving short-term comfort. This mindset doesn’t come naturally, especially in crisis. It must be cultivated through preparation, self-awareness, and a commitment to rational decision-making, even when emotions run high.

The First Move: Secure the Foundation, Not the Flash

When a financial emergency hits, the first priority isn’t recovery—it’s stabilization. Think of it like a medical triage: not every wound gets treated at once. The most life-threatening injuries come first. In money terms, that means protecting your basic needs before worrying about credit scores, investments, or lifestyle. The essentials are simple: a safe place to live, enough food to eat, access to clean water, and critical utilities like heat and electricity. Everything else—subscriptions, dining out, non-urgent repairs—can wait. This isn’t about austerity for its own sake. It’s about creating space to think, act, and plan without the constant pressure of immediate survival.

I learned this the hard way. In the first days after losing my job, I was tempted to keep up appearances—paying for streaming services, ordering takeout, avoiding the reality of my situation. But that only made things worse. Once I paused everything non-essential, I freed up hundreds of dollars each month. I canceled subscriptions I barely used, switched to store-brand groceries, and stopped all discretionary spending. I didn’t sell my car—driving was necessary for job interviews—but I delayed maintenance that wasn’t urgent. These weren’t drastic cuts, but together, they created a buffer. More importantly, they gave me a sense of control. I wasn’t just reacting to the crisis—I was managing it. That psychological shift was as valuable as the money saved.

One crucial rule I followed: do not touch long-term savings or retirement accounts. It’s tempting to dip into a 401(k) or IRA when cash is tight, but the costs—both financial and emotional—are high. Early withdrawals often come with penalties and taxes, reducing the amount available and undermining future security. Worse, once that money is gone, it’s hard to rebuild. Instead, I treated my retirement savings like a protected zone—off-limits, no matter how bad things got. This wasn’t easy, but it kept one part of my financial life stable. It reminded me that not everything had to be sacrificed. Some foundations could remain intact, even in a storm. By focusing on what I could preserve, rather than what I’d lost, I maintained a sense of hope and direction.

Building Your Emergency Firewall: The Risk-First Approach

Looking back, the best decision I ever made wasn’t during the crisis—it was years before it happened. I had started building a small emergency fund, not because I expected disaster, but because I wanted peace of mind. At first, it was just $20 a week—barely noticeable in my budget. But over time, it grew into a cushion that changed everything. That fund didn’t make me rich, but it gave me time. Time to look for a new job without panic. Time to negotiate with creditors. Time to think clearly. The real value of an emergency fund isn’t the money itself—it’s the breathing room it creates. It turns a crisis from a five-alarm fire into a manageable problem.

Many people think an emergency fund needs to be large—three to six months of expenses—before it’s useful. But that can feel overwhelming, especially on a tight budget. A better approach is to focus on progress, not perfection. Start with a small goal: $500, then $1,000. Even that amount can cover many common emergencies—a car repair, a medical copay, a home appliance failure. The key is consistency. Treat the emergency fund like a non-negotiable bill, even if the amount is small. Automatic transfers from checking to savings make it easier to stick with. Over time, what seems impossible becomes routine. The fund grows not because of big windfalls, but because of small, steady habits.

Equally important is how the fund is structured. It should be liquid—easily accessible when needed—but separate from your daily spending account. A high-yield savings account is ideal: it earns a modest return and is FDIC-insured, protecting your money up to legal limits. Avoid investing emergency funds in the stock market or locking them in long-term CDs. The goal isn’t growth—it’s safety and access. You don’t want to withdraw money when the market is down or pay penalties for early withdrawal. The fund should also be psychologically comforting. If you’re afraid to touch it, it won’t serve its purpose. Name it something reassuring, like “Peace of Mind Fund,” and remind yourself that it’s meant to be used when life throws a curveball. This isn’t wasted money—it’s insurance against chaos.

Smart Tools, Not Magic Fixes: Using What Works Without Risking More

In today’s world, there’s no shortage of financial tools promising quick fixes. But in a crisis, reliability matters more than speed. I’ve tested several tools over the years, and the ones that helped most were simple, low-risk, and easy to use. High-yield savings accounts, for example, don’t offer spectacular returns, but they’re safe, accessible, and better than leaving money in a zero-interest checking account. I moved my emergency fund to one with a 4% annual yield—modest, but enough to keep pace with inflation. More importantly, it was FDIC-insured, so I never worried about losing my savings.

Cash flow apps also made a difference. I used a budgeting app to track every dollar, identify unnecessary spending, and set realistic limits. Seeing my expenses in real time helped me stay disciplined. I could adjust quickly if I overspent in one category, shifting funds from another. The app didn’t make money for me, but it gave me clarity—something I desperately needed. It turned vague anxiety into concrete data. I could see exactly where my money was going and where I could cut back. This wasn’t about deprivation. It was about awareness. And awareness is power when you’re trying to regain control.

Another useful tool was zero-interest payment plans. When I had to replace a broken refrigerator, I used a store offer with 12 months of no interest. I committed to paying it off within the promotional period, so I wouldn’t owe anything extra. This wasn’t free money—it was a temporary bridge. But it allowed me to spread the cost over time without adding interest. I only used this option after confirming the terms in writing and setting up automatic payments to avoid missing a deadline. The key with any financial tool is to understand the risk. If a deal seems too good to be true, it probably is. If it requires perfect behavior to avoid penalties, ask whether you can realistically maintain it. The best tools are the ones that work quietly in the background, reducing stress without introducing new risks.

When You Need More: Safe Paths Over Risky Bets

There are times when savings and budgeting aren’t enough. A medical emergency, a major home repair, or an extended job search can exceed even the best-prepared emergency fund. In those moments, the goal isn’t to fix everything at once—it’s to stabilize. One of the safest and most effective steps is to communicate. I reached out to my landlord, explained my situation, and asked for a one-month rent deferral. To my surprise, they agreed. Many creditors—utilities, loan providers, even some credit card companies—offer hardship programs. These aren’t gifts, but they can provide temporary relief: reduced payments, paused interest, or extended due dates. The key is to ask early, be honest, and follow through on any commitments made.

Community resources are another often-overlooked option. Local food banks, utility assistance programs, and nonprofit counseling services can provide real help without adding debt. I was hesitant at first—pride made it hard to ask for help—but I realized that using available support wasn’t failure. It was smart. These programs exist for a reason, and they’re designed to help people through tough times. I accessed a short-term rental assistance program that covered one month of rent, giving me critical breathing room. I also used a free financial counseling service to review my budget and explore options. These resources didn’t solve everything, but they reduced the pressure enough for me to focus on finding a job.

When borrowing is necessary, the goal should be to minimize cost and risk. I considered a personal loan from a credit union, which offered lower interest rates than online lenders. I avoided payday loans, title loans, and buy-now-pay-later schemes with hidden fees. I also ruled out borrowing against my home or retirement account. The safest loans are those with fixed rates, clear terms, and manageable monthly payments. I calculated the total cost, not just the monthly amount, and made sure I could afford it even if my income stayed low. Borrowing isn’t inherently bad—but it should be a last resort, not a first response. The goal isn’t to eliminate the crisis overnight. It’s to survive it without making long-term sacrifices.

The Long Game: Turning Crisis Into Lasting Control

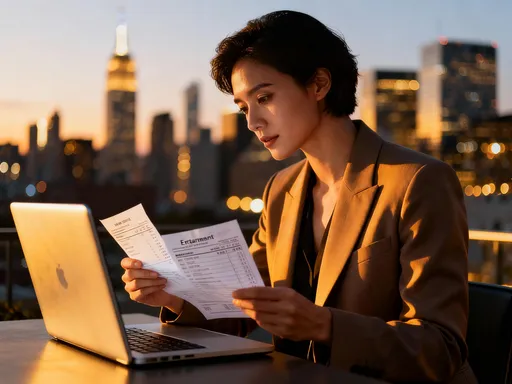

Emergencies don’t just test your finances—they reshape your mindset. Surviving one taught me more about money than any book or course ever could. I no longer see budgeting as a restriction. I see it as a form of self-respect. I don’t view saving as deprivation. I see it as preparation for the unexpected. The crisis didn’t just change my bank balance—it changed my habits, my priorities, and my confidence. I now do regular financial check-ins, reviewing my budget, emergency fund, and goals every month. I stress-test my plan: What if I lost my job again? What if a major expense came up? These aren’t sources of anxiety—they’re exercises in readiness.

I’ve also redefined what “safe” means. It’s not about having a perfect credit score or a large portfolio. It’s about having options. It’s knowing I can handle a setback without falling apart. This shift didn’t happen overnight. It came from small, consistent actions—paying myself first, tracking expenses, staying informed. I’ve built a system that works for my life, not against it. And when I do face challenges now, I approach them with calm, not panic. I ask, “What’s the next right step?” not “How will I survive?” That difference in thinking is everything.

The truth is, financial emergencies are part of life. They’re not a sign of failure—they’re a test of resilience. And resilience isn’t something you’re born with. It’s something you build, one decision at a time. You don’t need a perfect plan. You need a practical one. You don’t need to eliminate risk—you need to manage it. By focusing on control, not fear, and preparation, not perfection, you can break the panic cycle. You can face tight money without losing your peace. And when the next storm comes, you won’t just survive—you’ll be ready.